By Godwin Orozo-

Nigerians earning less than ₦250,000 monthly will no longer be required to pay personal income tax beginning January 2026, according to Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms.

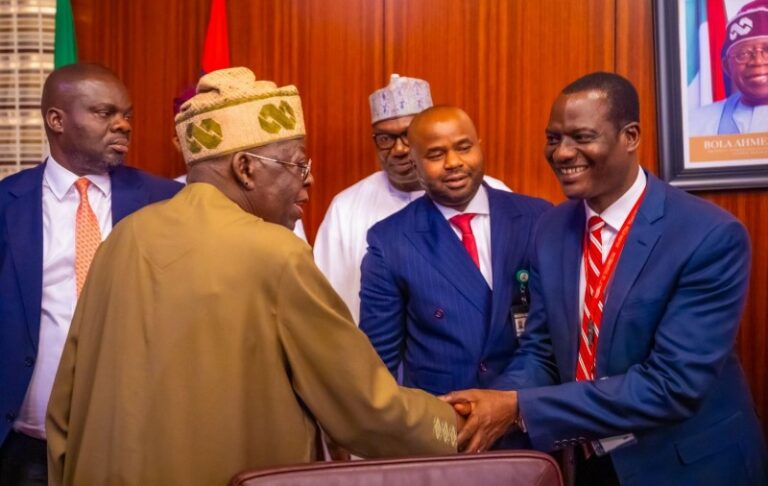

Oyedele revealed this on Thursday during an interview on Channels Television’s Politics Today, shortly after President Bola Tinubu signed four new tax reform bills into law.

“Anyone earning ₦250,000 or less monthly will be exempt from personal income tax under the new laws,” Oyedele said, explaining that such households are now officially considered poor by the government’s standards.

“The tax law will not put money in your pocket, but at least it won’t take money away from people who are already struggling,” he added.

Oyedele, who was appointed in July 2023, described his two-year tenure as “eventful and challenging” and said the reforms are designed not to raise taxes, but to stimulate the economy, boost compliance, and close tax loopholes.

“The new tax laws are efficiency-driven, growth-focused, and people-centric,” he said. “We’ve eliminated taxes for those at the bottom, reduced it for those in the middle, and slightly increased it for those at the top.”

He clarified that the reforms will ease the burden on a majority of Nigerians. “If you’re earning between ₦1.8 million and ₦2 million per month or less, your tax won’t be zero, but you’ll pay less than you do today,” he noted, estimating this group to represent about 5% of the population.

Explaining how the committee arrived at the ₦250,000 threshold, Oyedele said they considered Nigeria’s unique socioeconomic context.

“We asked ourselves: who is poor in Nigeria? The global poverty line is about $2.15 per person per day, but that doesn’t always apply here. Some people don’t earn that much but aren’t necessarily poor, they grow their food, don’t pay rent or transport. I know this because I grew up in a village.”

He continued: “We used a model based on a household of five, with two working adults supporting the family. The math showed that with a combined income of ₦250,000, such a household can barely get by. They’re not living in luxury, they’re surviving. So we concluded that they should not be taxed.”

Oyedele also lamented Nigeria’s poor tax collection record, noting that the country only collects about 30% of its potential tax revenue. “We are operating with a 70% gap,” he said. “These reforms are about plugging that gap, not by taxing the poor, but by targeting those who have the capacity to contribute and by improving efficiency.”